It has been an intriguing few days. They culminated, for now, in the “pause” announcement by President Trump yesterday concerning the reciprocal tariffs. The market responded with a ‘face-ripping’ rally, as expected.

I am rather certain that the pause was on the mind of President Trump when he announced the tariffs, but surely the looming collapse of the credit markets played a role in the timing. Last Thursday I noted:

I think, however, that many analysts are overreacting to the announcement. Tariffs have been used for ages, and now the negotiations for opening the world trade commence, de facto. Still, the short-to-medium-term (months to years) effect can be very detrimental to the global economy if the tariff wars continue and escalate. I am keen to think that they will not, but I cannot say this with high confidence.

And so, we are here, after some rather brutal market reactions. Very little actually changed, though. Recession is still incoming, 10% tariffs stay in place (125% for China), the U.S. federal budget deficit keeps on growing, and geopolitical tensions are on the rise. Since February, we at GnS Economics have been warning of a draining of market liquidity in April, and we anticipate market-support measures from Chinese leaders soon. Still, without any major (positive) central bank announcements, I don’t think we have seen even the short-term (monthly) bottom in the indexes yet.

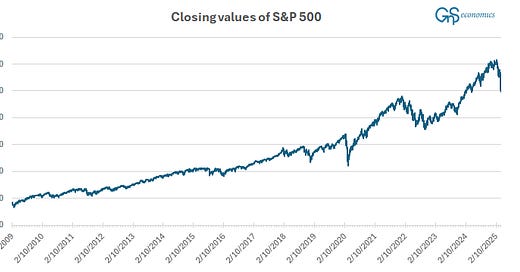

What is missing in the playbook of many investors is that we are at the last ‘gasps’ of a major bull market, which has run since 2009 with essentially just two interruptions: the Corona panic in March 2020 and the Russo-Ukraine war/inflation slump in 2022-2023.

Keep reading with a 7-day free trial

Subscribe to Tuomas Malinen on Geopolitics and the Economy to keep reading this post and get 7 days of free access to the full post archives.