Issues discussed:

The unsustainability of China’s debt load.

China as the failing engine of the world economy.

The approaching global ‘Minsky moment’ (a major credit event) driven by China.

The mainstream narrative on the ‘almighty’ Chinese economy has suddenly started to crumble. The trigger for this has been the no-show of the touted Chinese recovery after Corona lockdowns, which were removed in January, and the re-emerged woes in China’s real estate sector.

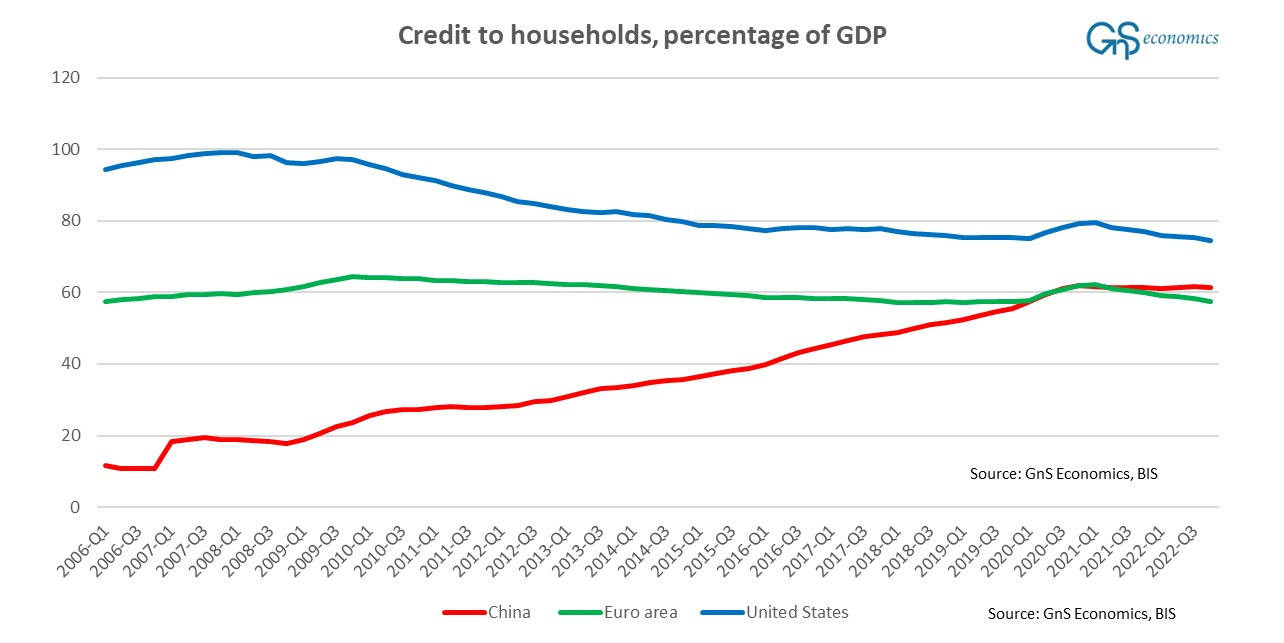

In late January, we warned that the China recovery is likely to be a ‘dud’ due to the massive amount of debt Chinese households have accumulated. There simply was no “bend-up demand”, which Beijing argued (expected) would lead to a rapid economic growth, or a recovery.

Chinese households currently hold a higher debt-to-GDP ratio than households in the Eurozone. To compare, at the end of 2022, the gross domestic product per capita of the Eurozone was over three times higher than that of China, while the U.S. GDP per capita was over six times higher. China is still a developing economy and her households are drowning in debt, but they are not alone. The whole Chinese economy has become saturated with debt, like we have been warning for some time (see, e.g., this, this and this).

Alas, the woes presented in the media are only a part of the story. I will now take you through a chart-show collecting our main findings from China for the past six years, to provide clarity on why the Chinese economy is in ‘dire straits’ and why it matters so much for the world economy.

Debt: To the moon!

One of our most striking findings on the Chinese economy is depicted in this graph.

Keep reading with a 7-day free trial

Subscribe to Tuomas Malinen on Geopolitics and the Economy to keep reading this post and get 7 days of free access to the full post archives.