I just went through our Special Report from December 2017, entitled “The approaching perfect storm”. As a forecaster, it’s always very pleasing to read past forecasts that have shown the way forward so correctly (and vividly).

Here are some excerpts:

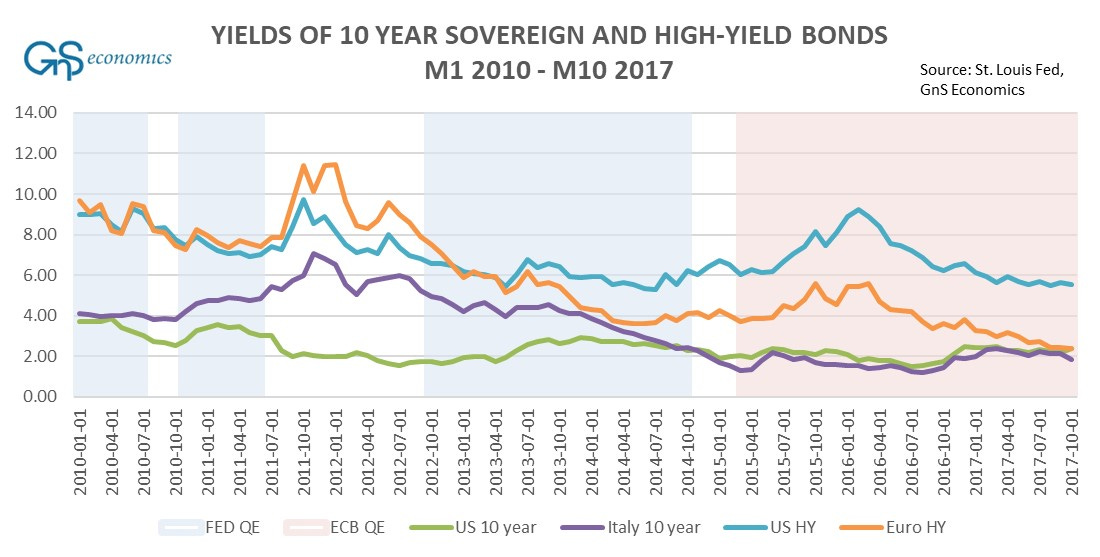

Moreover, after 2009, the central banks have always run to the rescue in heavy market

turbulence, which notably happened in 2008/2009, 2011, 2012, 2013, 2015, and 2017. This has created an extraordinarily dangerous market environment, where the market-wide losses and risks have been socialized by the central banks. The market participants have adjusted to this low risk, thus attracting them to buy riskier (and higher yielding) products and to leverage ever more (to gain sufficient profit from low yielding products). In the words of Hyman Minsky: “stability is destabilizing”.

What Figure 2 [presented below] implies is that the market risks have been pushed into the far ends of the probability distribution, which has effectively made them invisible (see Q-review 1/2016).

If the central banks and China really go through with their plans, noting that China can also just run out of options, 2018 is likely to be the year, when the first signals of the crisis will appear. These include serious market turbulence, bank failures and possible panicky responses from the central authorities. In 2019, the crisis would get to the full swing when the last efforts of the central authorities to uphold the global asset bubble would become exhausted.

The first two points have become very clear during the past year with near-implosion of the Japanse yen, British pound, British pension funds and Credit Suisse. The level of risk even fixed-income investors have been forced to take has been massive and the (artificial) central bank liquidity, from QE -programs, have effectively hidden them from ‘plain sight’.

The third excerpt is from the Conclusions of our December 2017 report, and it turned out to be a rather accurate forecast. Starting from October 2018 (the global central bank balance sheet started to diminish in August/September 2018), there was serious market turbulence, which eventually forced both the People’s Bank of China and the Federal Reserve to react. In December 2018, the PBoC was forced to start emergency support operations to keep the banking system of China afloat. The Fed was forced to the now infamous ‘pivot’ in early January 2019 to stop the collapse of the credit markets.

In mid-September 2019, the repo -markets of the U.S. were at the brink of collapse, forcing the Fed to enact another massive support operation (known as “Not-QE”). The support operations of the FEd did not end, partly driven by the Corona crisis, since August this year, when the QT started.

Now, like in 2018, the diminution of the global balance sheet of central banks (global QT), has already led to notable market turbulence saved only by recent speculation of peaking of inflation and yet another ‘pivot’ of the Fed. And there will, most likely, be much more turbulence to come.

Some have also wondered, quite understandably, why our November GDP forecasts were not “collapse-like”. It’s because it’s one scenario (of three) in our thinking, but not the most likely one, yet. We return to this in more detail in December.

But, what signs imply that a ‘perfect storm’ would be starting and how is it going to proceed?

Keep reading with a 7-day free trial

Subscribe to Tuomas Malinen on Geopolitics and the Economy to keep reading this post and get 7 days of free access to the full post archives.