Issues contributed:

The change in the composition of global financial enviroment as a fragile one has not been widely understood.

Global banking crises seem to have started already in 2020, but has been hidden (in plain sight) by authorities.

These two issues combined with the quantitative tightening of the Fed create a risk of a sudden and a catastrophic collapse in global market liquidity.

Recently, I read an excellent Twitter thread by a former hedge fund manager, under the pseydonym MacroAlf, on the risk of approaching liquidity/systemic crisis. He also publishes an excellent newsletter, The Macrocompass, which I recommend you to check.

Macroalf (Alfonso Peccatiello) concentrates on the MMF, excess reserves (above reserve reguirements deposits of banks in the central bank) and repo-markets to explain why the quantitative tightening of the Federal Reserve is likely to lead to a liquidity crisis within the 6-9 months.

I whole-heartedly agree, but like to add two important points to this, which practically make the onset of a liquidity crisis a near-certainty.

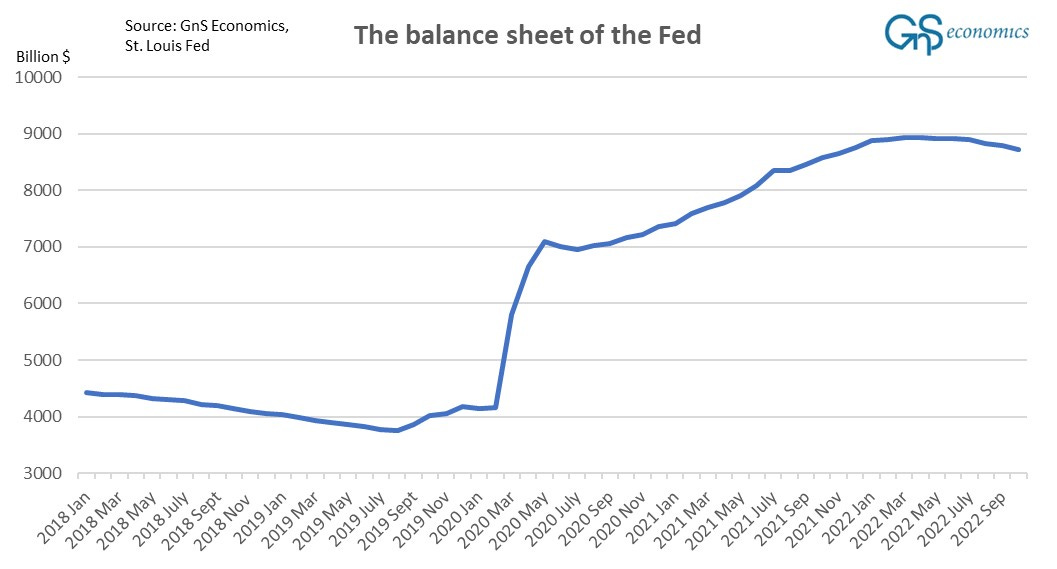

QT and that ‘sucking sound’

First is the fact that quantitative tightening (QT) is also draining liquidity from investors (households, institutional investors, etc.), as it reverses the process of quantitative easing (QE), which created not just central bank reserves, but actual bank deposits. I have explained this still rather badly misunderstood feature of QE in my piece at the Epoch Times. I recommend you to read it.

In another column, I shortly explained the dynamics of QT:

In it, the central bank rolls off (sells or doesn’t reacquire assets after they mature) investment grade assets from its balance sheet, which results in an over-supply of these same assets. This pushes their price down (yields up) followed by even bigger increases in prices of non-investment grade assets, because their risk/profit ratio worsens with the increasing yields of investment grade assets. This starts a flight to quality (to less risky bonds), which disperses the yields and spreads of the investment and non-investment grade assets further.

In addition, however:

QT also draws (artificial) central bank liquidity (credit), created by QE, from the markets, because when the asset is sold to a non-bank entity, he/she will pay it with cash (deposits). That diminishes the cash balances in the banking sector (see my column for an explanation on how the central bank pays the assets in QE).

This is the crucial part, mostly missed by MacroAlf. When a central bank rolls off assets (bonds) from its balance sheet, they (Primary Dealers) either sell it to investors or it returns to the Treasury through maturing meaning that the Treasury buys it back. Now, if the government is not running an austerity program (balancing its budget), the Treasury will borrow the matured amount from investors by issuing a bond to replace the matured one. An investor will buy the bond, which diminished his/her cash holding, i.e., market liquidity.

This is the mechanism through which central bank credit (QE) or “artificial liquidity” is withdrawn from the markets with QT. In a highly levered financial environment, like the one we currently live, this spells serious trouble .

As we explained in our blog, this mechanism combined with all the other financial ‘perversion’ QE created, is what led to the near-collapse of the repurchase (repo) markets in mid-September 2019. Now, it’s the aim of the Fed to decrease its balance sheet with one trillion dollars per yer (good luck with that), and this time its effects will be truly global.

The worrying fragility of the financial system

The second one is the fact that the global financial environment has changed quite drastically after the Global Financial Crisis (GFC) driven by no small part by QE, NIRP and ZIRP, and the ‘Corona bailouts’.

In October 2018, we published an (ominuous) blog on the “ominuous problem” with global liquidity. Based on a report by the Bank of International Settlements, BIS, we outlined three major fracture points in the global credit (liquidity) environment:

Global outside-US dollar denominated debt has risen to a record.

The role of non-bank institutions on providing funding has increased.

The composition of international credit has shifted from bank loans to debt securities.

Then we wrote:

Currently, non-banking institutions and households outside the US hold over 11.5 trillion worth of dollar-denominated debt—a record. The “shadow banking” sector could conceivably hold the same amount. This means that all policies affecting global dollar liquidity, will have a large effect on the global economy.

The increased role of non-bank institutions in providing credit means that an increasing proportion of international finance comes from unregulated sources. Effectively, this means that these institutions, including money market funds, investments banks, etc., have unwittingly assumed even bigger risks in their lending practices than commercial banks. This also means that when the downturn comes, the share of non-performing and/or defaulted loans will grow higher than before.

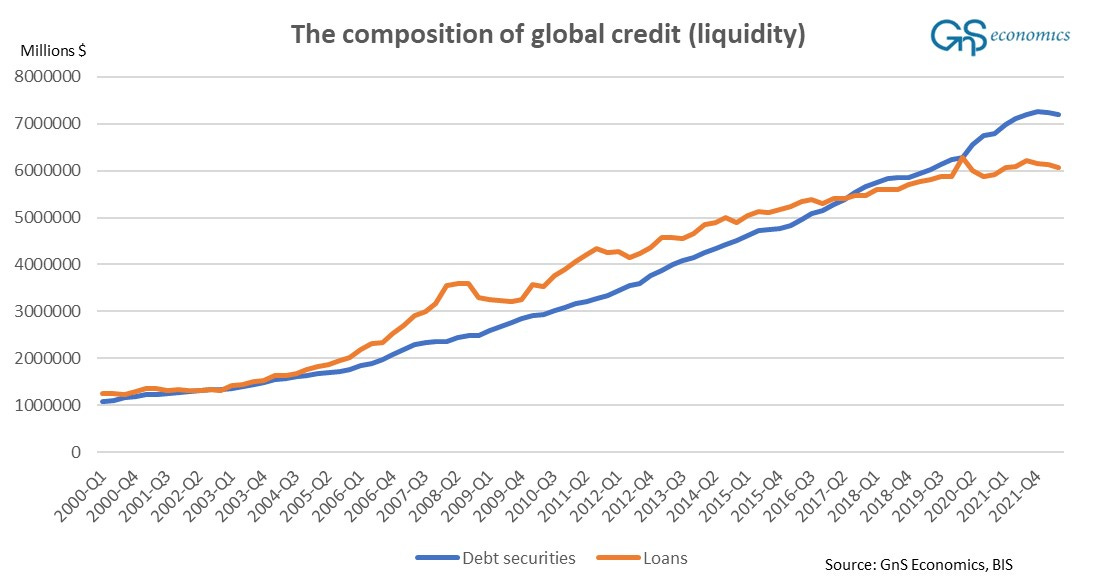

The main point here is that basically all through modern era, commercial banks have been the main providors of credit, which has now drastically changed. The figure below presents the development of the provision of global credit based on sources (loans and debt securities) from Q1 2000 to Q2 2022:

The figure clearly shows the massive increase in the role of banks before the GFC and the collapse of it after the Panic of 2008, but also the rather steady decline in the trend since. The effects of the debt crisis of the Eurozone in 2010-2012, which actually was a banking crisis, are also visible.

Most importantly, the figure shows debt securities passing bank loans in global credit creation in early 2017, and the collapse (stagnation) of bank loan creation after the Corona shock of early 2020 accompanied with the massive increase in the debt securities. These tell us two things.

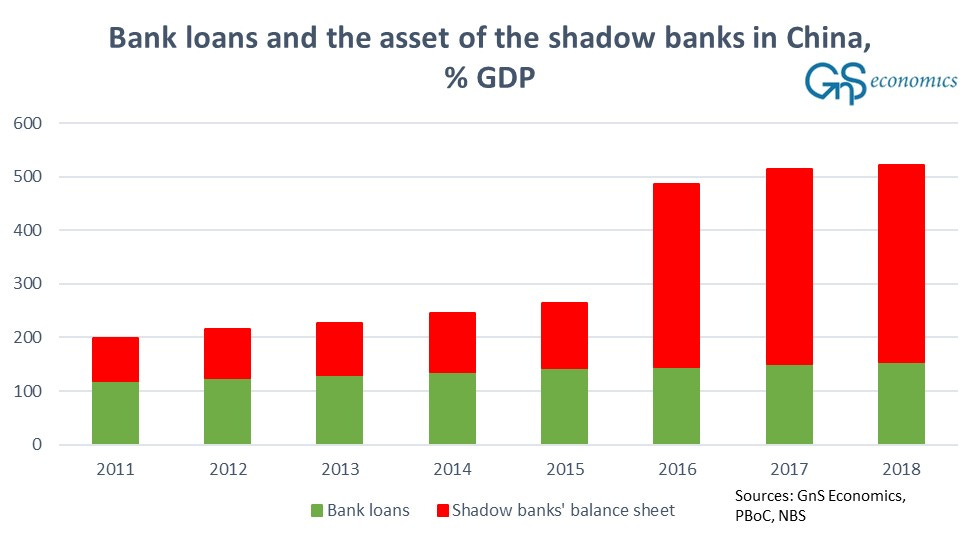

First, the global ‘mini-recession’ in 2015-2016, which was caused by de-leveraging efforts by Beijing, was a clear turning point in the global business cycle. Then Beijing enacted a massive stimulus campaign run through the shadow banking sector. This meant that the unregulated sector, i.e., the shadown banking sector of the banking industry increased their role as providers of global credit (liquidity).

This underlines the issue we presented in 2018. Because a higher share of global credit provision is on the hands of unregulated banks, this means that they have, almost surely, taken bigger risks in their lending activities are thus more prone to losses, when the downturn hits.

The increased role of debt securities also implies that corporations have been turning more on the capital markets in their search for funding. This is not surprise, as their yields have been extremely low. Now, they are not and they are rising rapidly, which means that many, especially ‘zombified’ corporations may (are likely to) start to fail in ‘hordes’, which would almost certainly lead to a sudden collapse in liquidity.

Secondly, the banking sector took, what looks like a mortal hit during the Corona lockdowns, as we correctly assumed. Banks and especially the European banking sector has been kept standing only through a series of support measures. Alas, we entered another global banking crisis already in 2020, but it was covered (hidden) by the authorities.

These two issues are creating an extremely precarious situation in the global financial markets, where we might (are likely) to see a castrophic collapse in the provision of global credit, when the crisis truly gets going.

Something horrible this way comes

Today, Brad Setser, a CFR Senior Fellow, published in interesting Twitter thread showing widening global trade imbalances driven by China and energy exporting countries. This, as he quite correctly puts it, implies a rising scale of global financial flows.

This appears in a situation, where our global financial system is more fragile than ever, global economy is effectively sinking and sanctions are used in an effort to heavily alter the global trade and thus the financial flows, which is likely to create all kinds dislocations in the global financial architecture.

Moreover, the Federal Reserve is draining global dollar-liquidity at an increasing speed putting pressure on the global financial system, which has ‘piled up’ on dollars like no time before. In addition to QT, the cost of holding dollar-denominated debt has also risen and will keep rising fast with the interest rates. Higher interest rates in the U.S. will also drain dollar-liquidity back to the U.S. Alas, the Federal Reserve is pulling the ‘mat’ under the highly-dollar-levered global financial system.

Already in October 2018, we concluded:

The collapse of the ‘everything bubble’ created by central banks does thus directly threaten not just asset markets but also the real economy. If (when) the asset markets crash, we will see a dramatic fall in global liquidity which will paralyze both capital investment and consumption. A perfect storm in global capital markets, banking sectors and—most importantly—the real economy is likely to develop with frightening speed.

We can safely say that the situation is materially worse now. Just imagine what would happen to global trade, and European energy security, if the provision of market liquidity would dry up leading to a crash in the financial markets freezing the global financial system.

Unfortunately, as explained above, that is the direction of travel. It’s not clear how aware central banks and especially the Fed are on this, but I worry they have failed to grasp the whole picture of their actions.

To be honest, I am starting to be quite worried to where this all leads to. We (the world) are, quite literally, sitting on a financial powder keg, and the fuse it lit.

Disclaimer:

The information contained herein is current as at the date of this entry. The information presented here is considered reliable, but its accuracy is not guaranteed. Changes may occur in the circumstances after the date of this entry and the information contained in this post may not hold true in the future.

No information contained in this entry should be construed as investment advice. Readers should always consult their own personal financial or investment advisor before making any investment decision, and readers using this post do so solely at their own risk. Readers must make an independent assessment of the risks involved and of the legal, tax, business, financial or other consequences of their actions. GnS Economics nor Tuomas Malinen cannot be held i) responsible for any decision taken, act or omission; or ii) liable for damages caused by such measures.

One way or another, the global financial party is over. Even in the unlikely event that Central Banks can muddle through the current raft of problems the collapse of Globalisation and birth rates across the entire world means that the economic outlook over the next few years/decades is utterly dismal. I highly recommend that everyone reads: The End of the World Is Just the Beginning: Mapping the Collapse of Globalization By: Peter Zeihan