Monthly forecast

July: Calm before the storm

Manufacturing recession has effectively arrived to the U.S. and Europe. China increased debt stimulus heavily in June, which I expect to continue in coming months. Yet, dark clouds are gathering over the world economy.

The U.S. is in (technical) recession after two consequtive negative GDP prints. Our forecasts indicate that recession will continue and deepen. The Eurozone and Finland would follow suit during the ongoing quarter. But, one should note the considerable uncertainty included in the forecasts at the moment.

United States

While the survey of the New York Fed saw a an uptick in business conditions of the manufacturers (from -1.2 to 11.1), the index for future conditions plunged to -6.2. This was the second lowest figure ever recorded matched only by the September 2001 print of -11.2 driven by the terrorist strikes to the NYC. Also the general business index of manufacturers in the Texas region come out positive (3.8), but new orders index sank further to -9.2. General business activity declined to a new post-pandemic low of -22.6. The survey of the manufacturers in the Philadelphia Fed region saw a drastic drop in new orders and expected new orders.

The U.S. consumer is also starting to be ‘tapped out’. The share of consumer credit as a share of real disposable income has reached a record level, with credit composing of more than 30% of the disposable income. This is visible also in the surprise decline of the service PMI of the U.S. to 47 signaling a contraction (every value under 50 signals a contraction).

The U.S. economy is effectively taking the turns we warned in our April Deprcon Outlook, while even we did not anticipate the recession to start so quickly.

Economic activity is slowing notably, while inflation pressures remain high. According to the UBS, wage growth has accelerated, heavily, across all sectors of the economy. The labor market also remains tight, which means that wage pressures will keep up building.

It is thus no wonder that the Fed raised rates by 75 -basis points. Quantitative tightening has also begun, albeit slowly. The balance sheet of the Fed has shrank by meagre $25 billion since beginning of June. The pace should accelerate from here on, though.

Europe

The economy of Europe is effectively falling off the cliff, even though France posted a positive GDP print for Q2 (0.9% MoM).

In Germany, the indexes of the business climate have been heading downwards since early 2022. Now business expectations index of the IFO Institute is closing the lows reached during the lockdowns in the Spring of 2020. The index of business climate has also fallen to levels not seen since the Spring of 2020. The indexes of manufacturing and trade have effectively fallen of the cliff. German economy may thus already be in a recession.

The ECB ended its negative rates policy, which it had kept in place since June 2014 by rising the interest rate of the deposit facility to 0.0% from -0.5% in mid-July. The deposit facility is where commercial banks can deposit their excess funds and it thus affects the interest rates banks use in lending and borrowing (deposits). The ECB is expected to continue rising rates in September, which should be obvious as the pace of inflation in the Eurozone reached a harrowing 8.6% in June.

Thus, the manufacturing recession, which according to the data from Germany and the Eurozone in general (manufacturing PMI was: 49.6) is likely to have already begun, is likely to broaden in the coming months. I (we) expect that the recession will commence in the Eurozone during September/October.

China

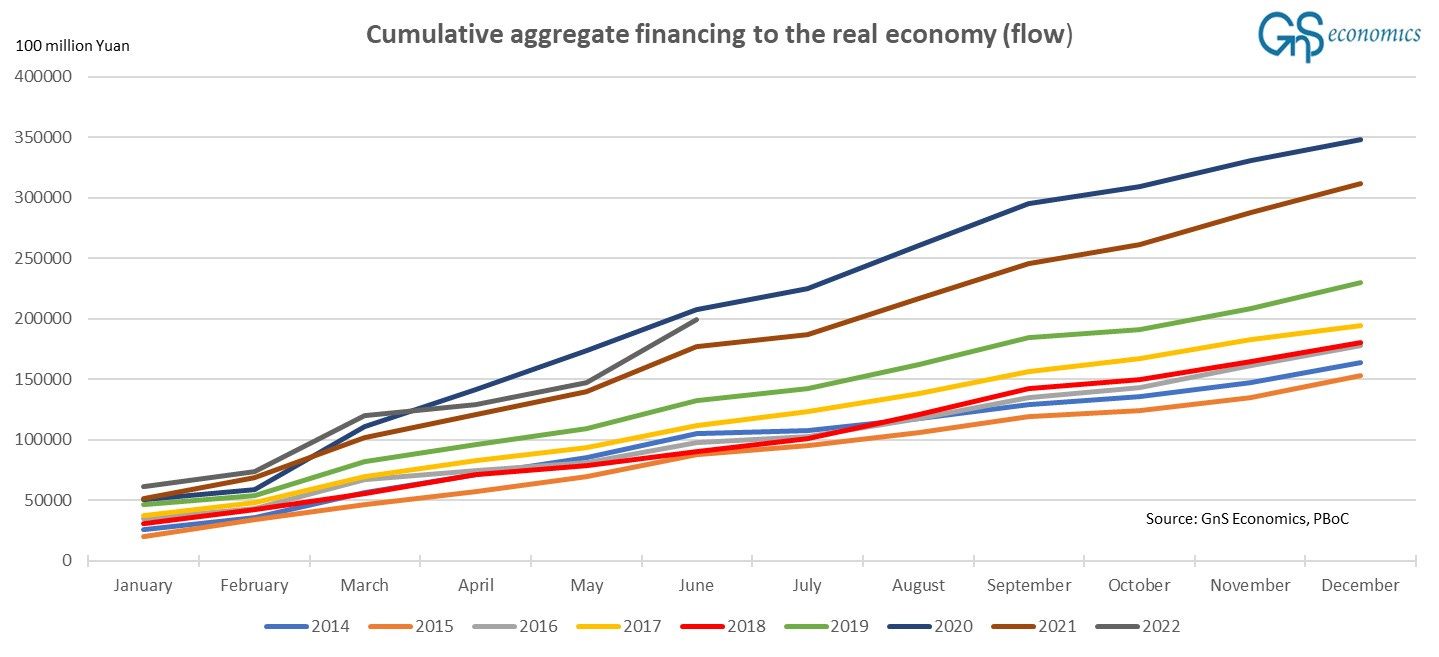

In China, June presented the first indications of the “infrastructure push” announced by President Ji Ping in April with the cumulative aggregate financing to the real economy posting one of the biggest monthly increases on record.

Somewhat interestingly, though, cement production has not reacted to this, yet. It, rather naturally, tends to grow rapidly during the Summer, but this time it has not happened. Business confidence fell to a new post-pandemic lows, and it has actually been in a negative territory since July past year.

Consumer confidence has, somewhat strangely, completely collapsed to never-before-seen lows during past two months. Some blame the renewed lockdowns, but they were much more wide-spread and strict during 2020 and 2021, and confidence is now way below the lows reached during those periods. These indicate that the Chinese economy may about to ‘give’.

It’s likely that if the renewed heavy debt-stimulus continues in the coming months, it will keep the economy ‘afloat’, but it’s also possible that the Chinese economy is reaching “debt saturation” on which we have been warning. This would mean that the effectiveness of further stimulus would be mediocre, because households and corporations have too much debt to absorb more. Coming months will show what the situation is.

Conclusion: not looking good

We are likely in a period of “calm before the storm”. Financial markets have rallied, especially in the U.S. from their lows in Mid-July. Still, the ‘clouds’ continue to gather. Inflation, interest rate hikes, balance sheet runoff of the Fed (QT) and looming shortages continue to ‘dig beneath the feet’ of our economies.

Alas, at the current trajectory, we will reach a point, where everything just starts to cave in. I (we) consider it will appear in matter of months, possibly in October or November.