Issues contributed:

BTFP: Not the ‘silver bullet’ you thought.

China: The giant with ‘(debt) clay feet’.

Markets: Into the oblivion.

I will now publish my first “random ramblings” on the economy and markets . I’ve been pondering writing this piece for a long time, and now I think that the time is ripe. The idea of these ‘ramblings’ is that I do not know exactly what it will be about, as I begin to write it.

I and our small team in GnS Economics constantly ponder the issues currently dictating the narratives of the markets and economy in general. In the GnS Economics Newsletter you only see the finalized analyses. However, in these Random Ramblings I will give a glimpse of what I, and we, are currently pondering. These will not be finalized reports, but a series of analyses that are still works in progress. They will provide more insight into our thinking, and subject our (preliminary) ideas to commentary by our community. I hope that these will increase interaction across out platforms.

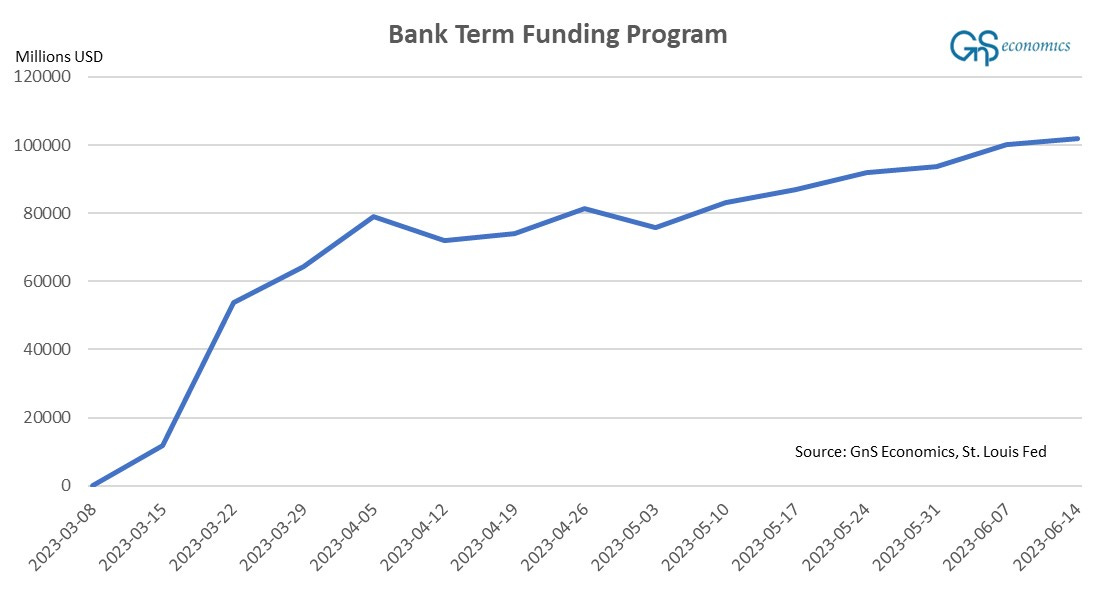

The first notion I would like to share, regards the Bank Term Funding Program, or BTFP. The total amount borrowed through it surpassed $100 billion for the first time this past week.

And this brings us to another topic I'd like to raise, which is the ability of the U.S. banks to tap in to the BTFP loans. This is rather crucial for the banking sector going forward. In actuality, the BTFP is not the deposit guarantee scheme of the Fed I (we) first assumed.

Keep reading with a 7-day free trial

Subscribe to Tuomas Malinen on Geopolitics and the Economy to keep reading this post and get 7 days of free access to the full post archives.