Issues discussed:

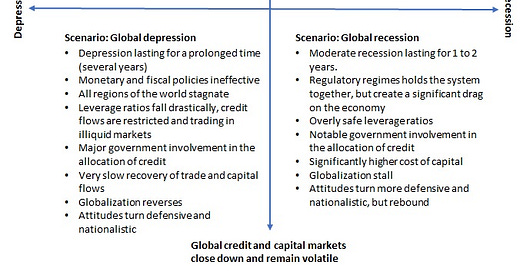

The three forms of crises we can face: an economic depression, systemic meltdown and hyperinflation.

The dire implications of the likely global bailout of financial markets by central banks.

The world economy is likely past the point of no return.

In December 2017, in our first-ever description on the process of the economic collapse, we envisaged the process of collapse in the financial markets:

When the crash occurs, it will set in motion three collapse-enforcing trends: panic in basically all financial asset markets, a debt deleveraging and a deflation -cycle and fall in the consumer sentiment.

When the crash in the asset market commences, the market pricing of risk will return, and with a vengeance. This means the reversal of the push of liquidity to riskier asset enacted by the central banks, a sort of leverage. In QE programs the central banks first bought the investment grade bonds, whose price fell. This meant that the investors needed to go to riskier products (from government to corporate bonds, for example) to obtain satisfactory yield. However, the central banks kept widening their purchases and the artifificial liquidity flowed to the corporate and other riskier bonds, which meant that the investors needed to go to even riskier financial products, like the junk bonds. This process has led to the above described absurdity, where for example the yield of the junk (non-investment grade) bonds has reached the yield of the sovereign debt of the US.

When the panic starts, the high-yield debt markets is likely to fall first, followed by the corporate bonds and the weakest sovereign bonds. This means that, suddenly, the interest rates of many financial products will skyrocket, leading to further panic in the asset markets, as banks, investors and institutional investors and funds try to cover their long (and short volatility) positions. This leads to a further asset selling and balance sheet deterioration as all asset classes start to lose their value. A vicious re-enforcing cycle of deleveraging and asset deflation will commence. The weaker banks, especially in Europe, will see their balance sheets deteriorating to insolvency. The interbank and bank lending rates will jump, and bank runs will ensue once the regular depositor understand the nature of the collapse. The corporate bonds markets and some weaker sovereign bond markets will freeze, leading to further raises in the interest rates. Corporate and household sentiment collapses. Investments will stop. Prices of the residential property and commodities are also likely to see large price decreases. The heavily indebted households and zombie companies will default and declare bankruptcies. The wealth funds, non-bank financial entities and pension and social security funds will see the value of their assets dwindling, and holes will start to appear in the financial fabric of modern societies.

I still consider this to be a good description on how the process of collapse could go in the financial markets. In this entry, I will update the process description and discuss the economic collapse more widely. I will concentrate on three likely processes: economic depression, systemic meltdown and global bailout (hyperinflation). In the third entry, I will provide more details on systemic meltdown, as it is the most dire process we can face. The fourth entry will deal with the timing of the collapse.

Please note that my Summer campaign, offering annual subscription to my newsletter, ends on 15 July.

Into the Collapse

Let’s start by noting that I consider it to be very likely that central banks will enact gargantuan bailout operations, when the collapse commences. This will naturally bring forth its own set of problems. Most notable, it would be likely to create pre-conditions for hyperinflation. Before getting into it, let’s first disentangle two likely scenarios of how the economic collapse could proceed: an economic depression and a systemic meltdown.

Keep reading with a 7-day free trial

Subscribe to Tuomas Malinen on Geopolitics and the Economy to keep reading this post and get 7 days of free access to the full post archives.