I have studied the history of economic crises for over 12 years. Based on that I have to say that things have never been crazier than they are now.

In the depths of the global financial crisis at the end of 2008, standard monetary policy tools of central banks became exhausted. These include open market operations, standing facilities and minimum reserve requirements for credit institutions.

After slashing the Fed funds rate below one percent in October 2008, the Federal Open Market Committee (FOMC) decided that more drastic action was needed. Then Chairman of the Fed, Ben Bernanke, most likely envisaged that capital markets needed a bigger support to stave off the threat of destructive cycle of deflation that put the "Great" in the 'Great Depression'. So the Fed officials came up with an idea to start buying assets from the secondary market en masse.

Probably to make such measures sound like a part of the arsenal of monetary policy, they were called programs of Quantitative Easing, or QE. The Fed, who started the currently cycle of QE-programs, linked the QE tightly on the ability of a central bank to keep lowering long-term interest rates beyond 'zero lower bound' (where short-term rates are zero). However, QE-programs could have also been called a "partial socialization of the bond markets" to which the programs effectively evolved into.

Financial markets are now suffering on the aftermath of this central bankers’ “innovation”, and that is not good at all.

The Fed and the financial markets

We have explained the mechanics of QE in detail Q-Review 1/2018, and I will deal with the specifics of QE in my forthcoming posts, but basic mechanism on how QE affects financial markets is the following.

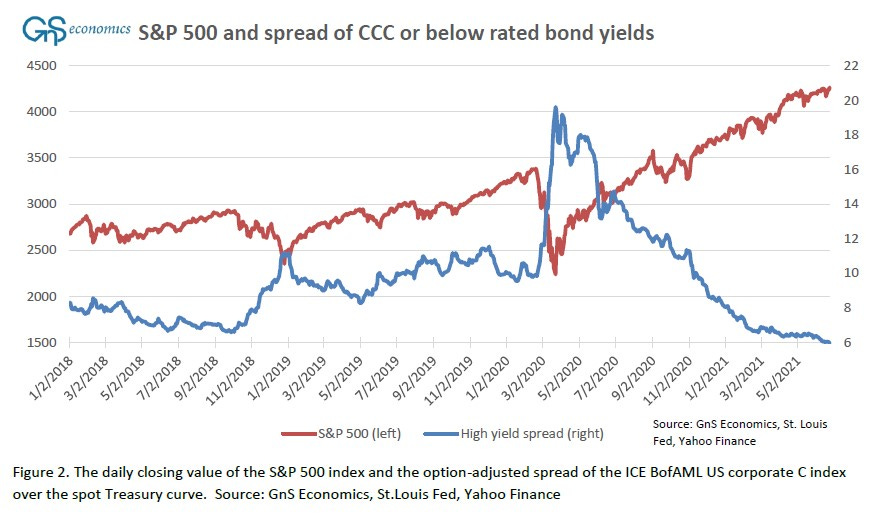

The central bank buys investment-grade bonds, whose yields fall as their price increases. This leads investors to seek higher yielding, and riskier, financial products. When the QE continues, the artificial liquidity from the asset purchases of the central banks spreads deeper and deeper into the financial markets until the yields of even the riskiest assets, like bonds of junk-rated companies, fall very close to assets considered near riskless, like U.S. Treasuries and over-night deposits at the central bank. Alas, an ‘everything bubble’ forms, where the prices of practically every asset in the financial markets becomes artificially inflated.

QE:s also alters the balance sheet of banks (more on this later), and lead investors to seek higher returns through leverage. The massive growth in margin debt is a clear sign of this. Usinge leverage (debt) to buy assets increases their return, but it also magnifies losses, which bears great risks.

The ‘Crypto Carnage’ in May was probably the clearest sign of things to come, as investors had used massive 100X leverage-ratios to speculate on the crypto currencies. When their prices started to fall, the forced de-leveraging, i.e. selling the asset to pay back debt, caused the prices to crash.

High leverage in junk bond speculation can easily lead to similar ‘fire sales’, which would most likely spread to other markets as well. We explained this process in December 2017.

When the panic starts, the high-yield debt markets is likely to fall first, followed by the corporate bonds and the weakest sovereign bonds. This means that, suddenly, the interest rates of many financial products will skyrocket, leading to further panic in the asset markets, as banks, investors and institutional investors and funds try to cover their long (and short volatility) positions.

This leads to a further asset selling and balance sheet deterioration as all asset classes start to lose their value. A vicious re-enforcing cycle of deleveraging and asset deflation will commence. The weaker banks, especially in Europe, will see their balance sheets deteriorating to insolvency. The interbank and bank lending rates will jump, and bank runs will ensue once the regular depositor understand the nature of the collapse.

The corporate bonds markets and some weaker sovereign bond markets will freeze, leading to further raises in the interest rates. Corporate and household sentiment collapses. Investments will stop. Prices of the residential property and commodities are also likely to see large price decreases. The heavily indebted households and zombie companies will default and declare bankruptcies. The wealth funds, non-bank financial entities and pension and social security funds will see the value of their assets dwindling, and holes will start to appear in the financial fabric of modern societies.

Central bankers and governments have been very innovative in preventing such a ‘perfect storm’, but now the road is ending.

The “bubble”

In our latest outlook for the world economy sent to our customers at the end of June, we warned on the extreme situation, or a ‘bubble’, in the financial markets. Here are some excerpts:

The biggest worry and risk regarding the world economy currently is presented in Figure 2, which presents the progression in yields of bonds of junk rated companies and closing values of the S&P 500 stock market index. The figure shows a record-breaking gap between these two speculative asset classes. It thus depicts the current state of the global financial markets, which continue to levitate in a bubble of never-before-seen dimensions.

But now we can confidently say that almost every single corner of the financial market is in some sort of a bubble. This is the end-result of the global policies of zero interest rates and quantitative easing, as we have warned repeatedly since March 2018.

The world economy and financial markets have been artificially supported for over a decade. Both fiscal and monetary stimulus have been enabled by extremely low interest rates. If rates rise, it will, without question, crash ‘zombified’ firms, banks, investors and households.

In May we warned that the waning credit stimulus of China, would lead to declining economic activity in Europe in June/July and in the U.S. in Aug/Sept.

The lag of the effect of the Chinese credit cycle is around 2-3 months for Europe and around 3-4 months for the U.S (see Figure 2). So, we expect that by July—perhaps as early as June—the economic bounce will flatten in Europe, and by August-September in the U.S.

With the contraction in German factory orders in May, this slowdown may arrived already earlier. Combined with rising inflation, this creates a rather precarious situation for the world economy and the markets.

The inflation scare, debt and unfounded optimism

When you look at the situation in the world economy, there’s just one conclusion one can draw: We are screwed.

Economies are opening, yes, but at the same time inflation has picked up, markedly, and the financial markets of the U.S. are signaling inability to cope with any more QE (more in this in the next post).

These developments are likely to force the Fed, and possibly also other central banks to end their decade-long support for the financial markets. At the same time governments are withdrawing their fiscal support, the only thing that has kept the economies growing after the deep slump caused by the corona-lockdowns.

So, it seems that both fiscal and monetary stimulus will be withdrawn at the same time during the summer. And, then there’s the “Delta-variant” of the coronavirus, which has led to speculation of further lockdowns.

Can there really be any other end-result to this than a ‘perfect storm’ engulfing the global economy and financial markets in late summer/early fall? I think not. The combination of massive ririsks and a waning economic momentum cannot lead to any other conclusion, imho.

I also have to admit that I do wonder, where the optimism of some of my colleagues, who are predicting that this would be the start of a new ‘Roaring Twenties’ (see e.g., this), arises from. The 1920’s economic boom was driven by innovations, including financial ones, which fueled one of the fiercest credit expansions in history!

While innovations are likely to emerge also now, households and corporations are more indebted than ever. The world is essentially drowning in debt.

I (we) could naturally be wrong, and the sun is shining (at least in Helsinki). But, if I (we) am (are) correct, a very drastic turn of (economic) events is lurking just behind the corner.

Beware.