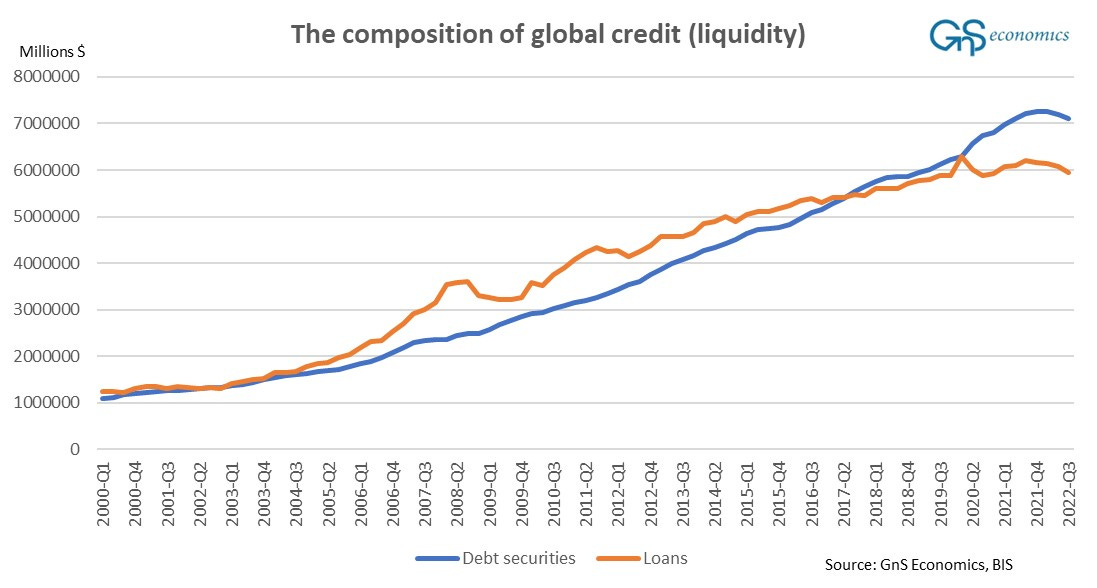

Global bank lending contracted deeply in Q3 implicating that we were at the verge of another banking crisis in early October. The issuance of debt securities also contracted notably driven in part by quantitative tightening, QT. Thus, it was no surprise that financial markets reacted as they did in September and October.

Like I noted in my previous entry, central banks and especially the People’s Bank of China (PBoC) raised the global liquidity and thus the markets from their depth in October and November.

For markets, the question is, how is global market liquidity going to develop in the near future? The combination of QT of the Federal Reserve and the European Central Bank (ECB) continues to be the ‘liquidity time-bomb’, but there are other notable factors at play which affect the timing of its “detonation”.

The ‘seasonality’ of the PBoC

When we observe the injections of money (liquidity) by China and the United States into the global financial system, we notice three important things.

First, China (basically the PBoC) has dominated the injections and withdrawals of global liquidity since late-2011. The only exception is the “Corona bailout” enacted by the Federal Reserve during the spring of 2020, when the U.S. liquidity injections surpassed those of China.

Secondly, China enacted massive liquidity injections during 2021 which, for their part, explain why markets rallied in 2021. 2022 saw much more modest injections.

Thirdly, there seems to be a clear cyclical or even seasonal pattern in the PBoC liquidity injections. This becomes apparent, when we consider the period between 2016 and 2022.

There’s a pattern of withdrawing of liquidity or, at very minimum, a decline in injections of liquidity in April, July and October. I currently have no idea, why this is, but these have held since at least 2010. For example, the only exception to the “April-draining” of Chinese liquidity is spring of 2020. Then the decline appeared not in April, but in May (for obvious reasons). The other thing is that March has usually seen a strong uptick in liquidity injections (no idea why that appears either).

These lead me to correct my earlier statement (made in the previous post) into this. Liquidity-wise, we could see a strong end of February, which is likely to weaken considerably during the latter part of March, when the April-draining of liquidity by the PBoC is likely to start. This naturally depends also on the actions of other central banks.

Central bankers ‘on the mend’

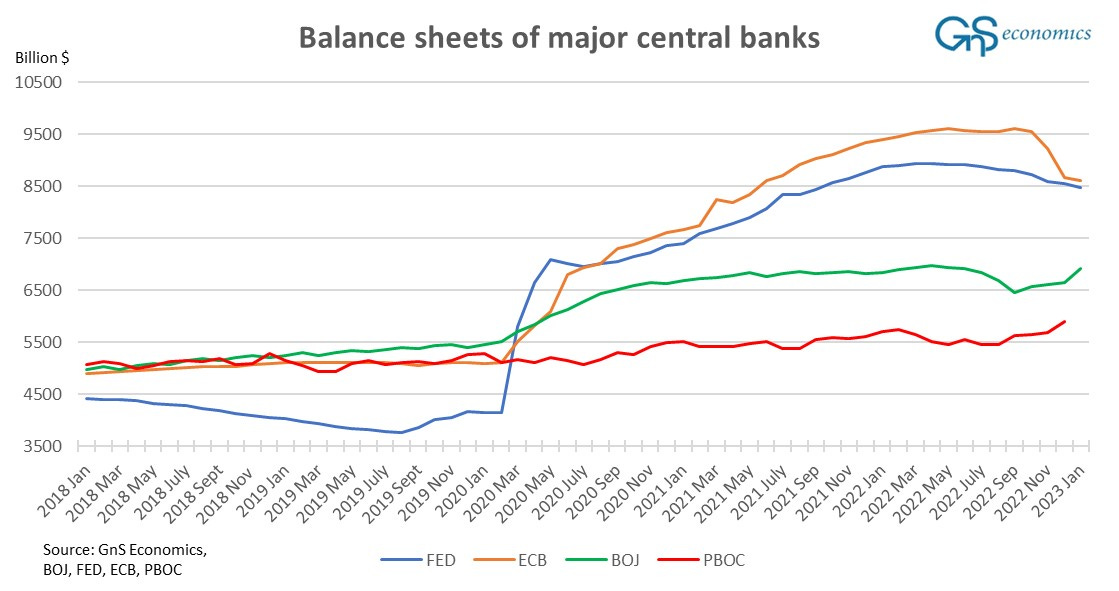

Essentially, the pivot of central bankers has already occurred. It has just not been “unanimous”, and the question remains, whether this is just a pause in QT.

Essentially, as shown in the figure, global balance sheet run-off of central banks was either paused in January or then this was the moment, when central bankers pivoted to further monetary stimulus. While I am not ready to announce global QT done, yet, it’s clear that central bankers are feeling the pressure and they most likely know, how precarious the situation in the financial markets is.

Where do you go when the road ends?

Alas, as we have been touting for several years now, you simply cannot walk back from the injections of massive artificial central bank liquidity, through asset-purchase programs (QE), into the markets without serious repercussions. This is what we saw, again, during September and October, and now we are at a' ‘hinge-point’.

If central bankers have not pivoted, that is, if they continue their QT programs full-steam, we will, most likely, face a situation during the spring, when market liquidity evaporates from underneath the global financial markets in never-before-seen fashion. This would lead to an epic crash escalated by the imminent global recession and the possible (likely) geopolitical tensions heating up across the globe, especially in Ukraine.

Naturally, another course is also possible. If central bankers have decided to, e.g., play a game of ‘smoke and mirrors’, where some (the Fed and the ECB) continue QT while others (the PBoC, BoJ and possible the Bank of England) return to QE, global central bank balance sheet may even resume growing. At the very minimum, this would flatten its decline.

If such a situation would occur (continue) during the spring, it would be likely to postpone the crash or, at least, diminish its severity, but it would also emphasize our point. That is, that we live in an utterly artificial markets, which are unable to sustain themselves without constant central bank support. That would be the first hallmark of the world entering into an “economic dystopia”.

Disclaimer:

The information contained herein is current as at the date of this entry. The information presented here is considered reliable, but its accuracy is not guaranteed. Changes may occur in the circumstances after the date of this entry and the information contained in this post may not hold true in the future.

No information contained in this entry should be construed as investment advice. Readers should always consult their own personal financial or investment advisor before making any investment decision, and readers using this post do so solely at their own risk.

Readers must make an independent assessment of the risks involved and of the legal, tax, business, financial or other consequences of their actions. GnS Economics nor Tuomas Malinen cannot be held i) responsible for any decision taken, act or omission; or ii) liable for damages caused by such measures.

They published a piece of news on various news networks, including Bloomberg, "China Urges State Firms to Drop Big Four Auditors on Data Risk". What state owned enterprise data has become or will become so crucial? Give me enough rope on this subject matter, but according to my understanding there are direct evergreen credit lines from those SOC's to both the PoBC and the shadow banking sector. Apocalyptic PoBC (April) draining ahead?

Regarding geopolitical tensions. Are there any valid reasons why not heating up? Ever worse scarcity of food and energy e.g. in the UK. According to my knowledge Brexit is not the dominating factor for their rationing. BR JKi