Problems in the repo market are persistent

And that is not good at all

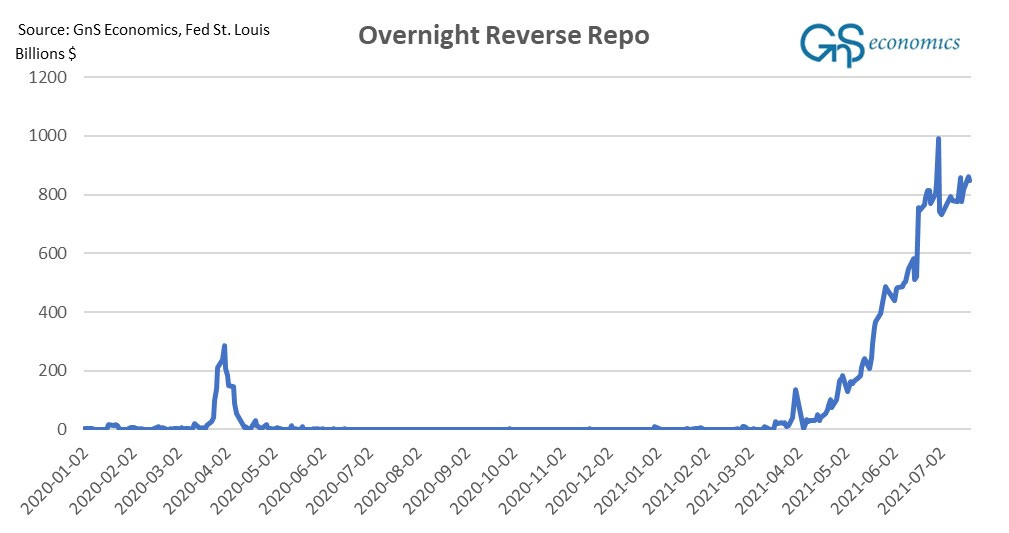

The usage of the reverse repo facility of the Federal Reserve bank of New York has been breaking records in recent weeks.

This very worrying development went mostly unnoticed in the mainstream financial media until the WSJ interviewed Zoltan Pozstar, a repo-market specialist from Credit Suisse, on the topic few weeks ago. Zoltan warned on the repo market turmoil, which hit in September 2019, already in August 2019 earning him a well-earned reputation as a ‘repo-market guru’.

As we specialize in macroeconomic analysis and forecasting, we issued a more general warning, in March 2019 , on the impending asset market crash between Q2 and Q3 2019 due to global quantitative tightening. Without the Fed enacting the same emergency measures (repo facility) it ran during the Global Financial Crisis, a crash would most likely have been realized.

During the ‘repo-panic’ in September 2019, rates of the repurchase agreements shoot up. This time, the direction is something of the opposite, as banks and other financial instutions are parking vast amounts of money into the reverse repo facility of the Fed over-night.

So, why is this so worrisome?

The repo -markets

We recently explained the functioning of the repo-markets, in Q-Review 6/2021 and also in our blog. Few excerpts.

The repurchase agreement, or “repo”, is a financial agreement in which the borrower agrees to buy back the security it sold to the lender at a later date for a higher price. A repurchase agreement is essentially a short-term loan backed by high quality collateral, most often 10-year Treasury bonds.

The repurchase agreement, or “repo”, is essentially a financial agreement in which the borrower agrees to buy back the security it sold to the lender at a later date for a higher price. In a reverse repo contract, which is the repo contract from the lender’s perspective, the investor buys collateral in the form of fixed income assets.

The reverse repo contract, which is the repo contract from the lender’s perspective, can also be used to invest cash. In a reverse repo, the investor buys collateral in the form of fixed income assets.

So, repo -markets are essentially a collateralized loan market. When you have sufficient (good quality) collateral, mostly Treasuries, you can obtain short-term funding from the markets. And, the other way around, if you have too much cash, you can park it into the reverse repo and earn a small interest.

Role of the repo in monetary policy

Repo markets are an essential tool for the Federal Reserve. They play a significant role in the smooth functioning of the financial markets, as they are used to finance large scale purchases in sovereign bonds, equities, and other similar assets. The Federal Reserve uses the repo market to conduct asset purchases (QE), but also to draw excess liquidity from the markets.

An excerpt from our blog.

The interest rate used in the repo contract can either be at a fixed rate or tied to a specific reference rate. The Federal Reserve publishes three different reference rates based on trading on the repo markets, which are updated daily on the Fed’s website. The most commonly-used repo reference rate is the SOFR-rate, which is derived from the Secured Overnight Financing Rate.

In mid-June, the Fed raised the interest rate of its reverse repo facility to 0.05% from zero.

QE and the fate of the banking system

In my previous post, I explained how the asset purchase programs (QE) of central banks affect the financial system and banks. We need few additional details to understand, why the situation in the financial system of the U.S. is so critical.

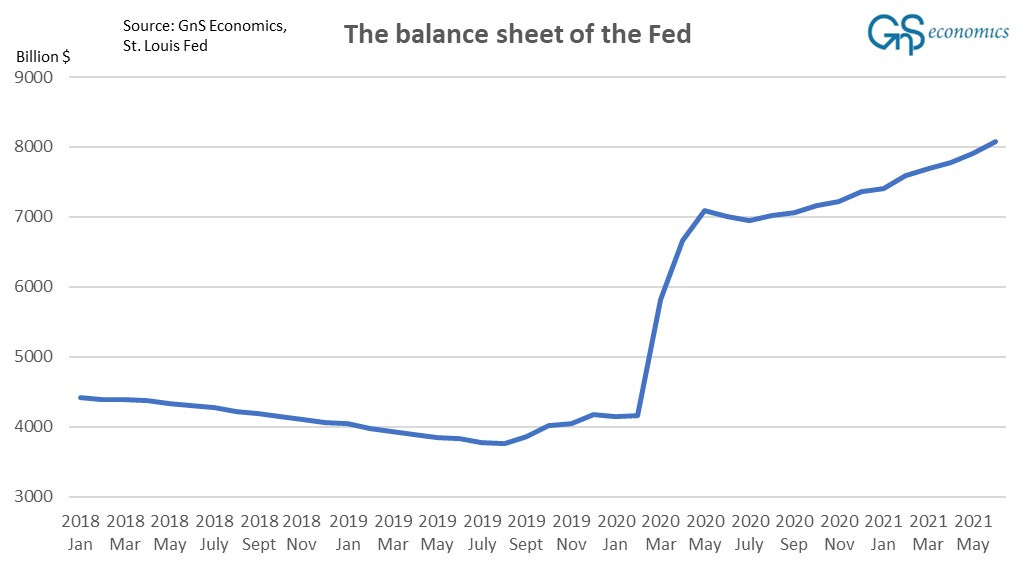

If we look at the cash balances of the commercial banks of the U.S., they have grown and diminished, more or less, in accordance with QE/QT.

Especially the massive ‘Corona bailout’ of the Fed in March-June past year, shows up clearly in the cash balances. During that period, the balance sheet of the Fed jumped by whopping three trillion dollars! And after that, the balance sheet has kept pushing upwards relentlessly.

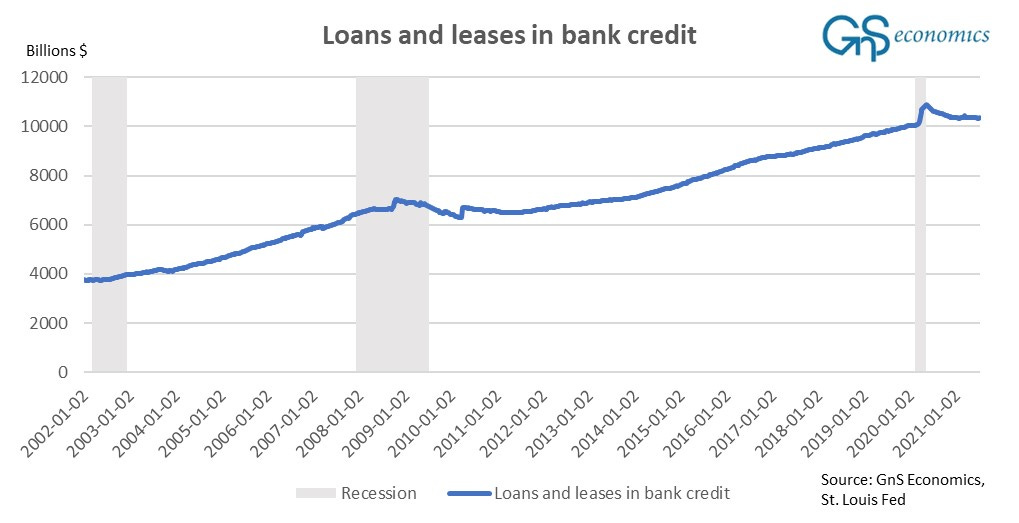

Like I explained in my previous post, banks have been counter-balancing the forced entry of the central bank reserves into their balance sheets by issuing riskier loans. While this, i.e., riskier lending, cannot be deducted from the general loan data of banks, it does reveal an interesting detail.

After the shortest recession in known history (February-April 2020), and a sharp uptick in lending during it, banks have not been issuing more loans but, in actuality, they have been in decline. It’s normal that after a financial crisis, like the GFC, the loan growth will sputter, but it should recover speedily if the banking system is sound after a normal economic downturn, like after the 2002 recession.

So, why does this “recovery” resemble something seen after a financial crisis?

Chickens are coming home to roost

There are all kinds of explanations floating around on why the usage of the reverse repo is spiking. These include Basel III regulations, increase of SOFR and the lack of good quality collateral.

We argue that the reason is ‘debt saturation’, that is, a situation where banks are unable to find investment projects with a good enough risk/reward -ratio to fund. This would mean that they would dumb all the excess cash forced upon them by the QE-programs back to the Federal Reserve. Implications of this would be dire.

Firstly, it would mean that a U.S. recession is imminent after the stimulus unleashed by the Biden Administration phases out. This for the simple reason that, if loan growth stalls or declines, investments will follow. Growth of domestic investments has actually already stalled in the U.S..

Secondly, it would mean that QE:s have become utterly inefficient in resuscitating the economy and the financial markets, and that they would have started to alter the financial system in a very troubling way.

It was the idea of the QE to “flood” the financial system with (artificial) liquidity after the GFC effectively drained the liquidity from the markets. Now, this seems to have been fully “achieved”, but with a serious twist. With close a trillion dollars parked at the Fed each night, the flow of liquidity has actually reversed. The Fed is now draining liquidity from the financial system, and so tapering (actually something of a QT) has already occurred, forced by commercial banks. This is likely to have been one main reason behind the recently increased volatility in the financial markets.

Moreover, if QE programs were to continue, they would ‘mutate’ the banking system by forcing the banks to shy away from further deposits (cash) from firms and households. It would thus corrupt the basic function, deposit taking, of the banking system and possibly massively increase the number of money market accounts. This way banks would become more heavily involved in the money markets, which would increase their risks and speculative nature.

Thus, I argue that there’s no other path for the Fed than to taper, in all honesty, possibly as soon as August (announcement maybe in Jackson Hole). This for the simple reasons that 1) the Fed has effectively already tapered, and 2) the central bank will not want the U.S. banking system to turn into a ‘banana republic’, which is unable to perform its basic duties, like deposit taking.

And, if the pace of inflation remains high, or even accelerates, the Fed will be forced to start to consider actual rate hikes. Combination of a taper announcement and rate hike speculation would, most likely, be very detrimental to the extremely-levered and speculative financial markets.

Alas, we may have just one month of ‘smooth sailing’ left. Maybe, just maybe, it’s time to start preparing.