Issues discussed:1

Unrealized losses of U.S. banks have grown, again.

Fragility in the U.S. banking sector keeps increasing the likelihood of a nationwide bank run.

Authorities are likely to propose a digital dollar, as the solution to the (approaching) second wave of the banking crisis.

On 24 February, I wrote:

We can just speculate what were the drivers of the decline in the share of Tier 1 to assets (both risk-weighted and overall). Yet, the fact remains that U.S. banks are less capitalized than they were prior the pandemic. Thus, the U.S. banking sector has been turning fragile and its likely to continue doing so, when the downturn truly hits.

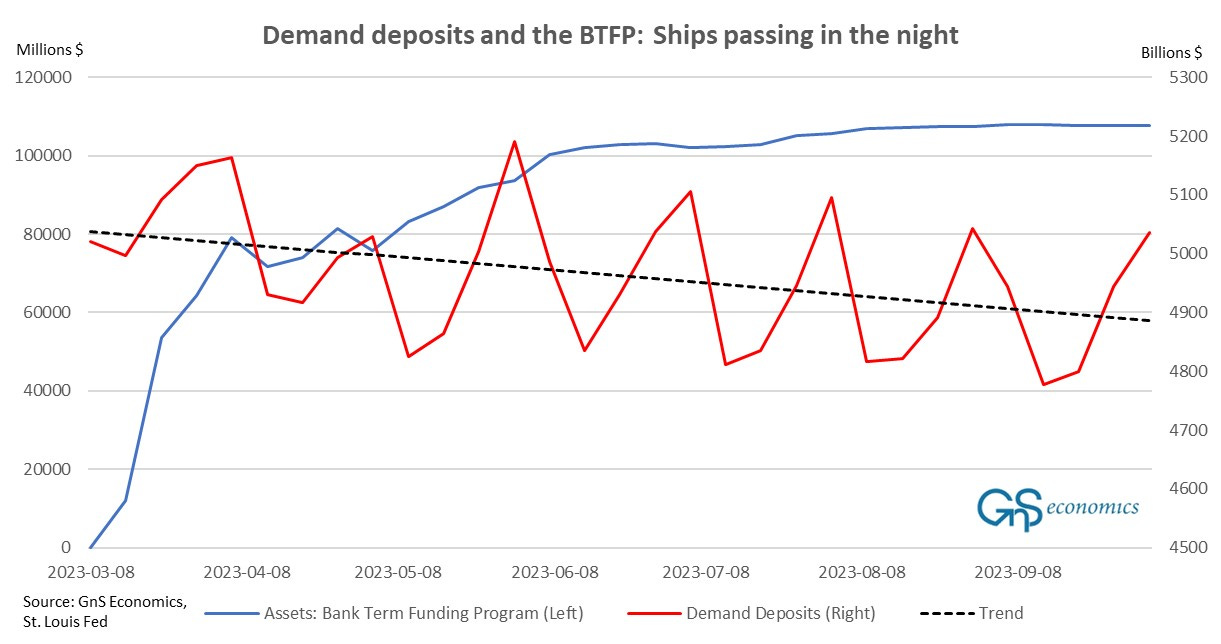

Three weeks later this fragility exploded with the failures of Silvergate Bank, Silicon Valley Bank (SVB), Signature Bank, and the First Republic Bank. Bank runs were stopped from spreading nationwide through exceptional measures taken by the Federal Deposit Insurance Corporation, or FDIC, and the Federal Reserve. Deposits were guaranteed and the Fed setup a Bank Term Funding Program (BTFP), where banks could exchange their securities for (anonymous) one-year loans. The main idea of the BTFP, most likely, was to turn ‘rotting’ U.S. Treasury notes and bonds, on the balance sheets of banks, into investable assets.

U.S. banks were (are) sitting on a very large amount of unrealized losses from Treasuries, which have lost most of their value due to rapidly rising yields driven by inflation and the record-breaking rate hiking cycle of the Fed. Those interested in the gimmicks of it all, can check my online lecture or read my long piece in the Epoch Times on the topic.

Treasuries are, naturally, among the collateral accepted by the BTFP, which means that banks have been dumping their Treasury holdings to the Fed. In effect, the BTFP has just masked the bank run, by turning it “silent”. This makes it look like everything is just ‘peachy’ in the U.S. banking system, while bank runs have continued, almost unabated, since March (like I explained to my paid subscribers on 1 September).

Worryingly, the Q3 data indicates that the U.S. banking sector continues to sink. We have actually issued our first warning based on our findings, which I strongly urge you to check, if you have money in U.S. banks. In this piece I will detail some important aspects behind our warning.

Two other ships passing in the night

Keep reading with a 7-day free trial

Subscribe to Tuomas Malinen on Geopolitics and the Economy to keep reading this post and get 7 days of free access to the full post archives.