Issues discussed:

Bank credit data keeps on indicating the onset of an U.S. (private sector) recession.

Economic indices and data on consumers seem to concur, while credit markets continue their ‘deep-sleep’.

Depression-style fiscal stimulus by the Biden administration is keeping the U.S. economy afloat, but it will be unable to stop the downturn.

I like to remind you on my Summer campaign, offering annual subscription to my newsletter with 20% off. The offer ends on 30 June.

Credit recession continues

Let’s first update the situation in bank credit. The (annualized) growth of loans and leases of U.S. commercial banks keeps on hovering at recession levels.

The (annualized) growth of commercial and industrial (C&I) loans has returned to smallish growth during the past two weeks. Yet, I am rather certain that this does not constitute as an actual recovery of the U.S. corporate sector.

This is because the demand for C&I loans is still deeply in contraction territory according to latest data (Q2). While the share of U.S. banks reporting stronger loan demand has somewhat recovered from its deep slump in 2023, the share is very far from signaling an actual recovery in loan demand. This is another metric that has never been in such a deep slump without a recession. Most U.S. banks are also still tightening lending standards to small and medium-sized as well as to large firms.

Economic indices signal contraction

Like I have been noting several times, the Great Depression -level fiscal stimulus, is currently carrying the U.S. economy. However, private sector recession is starting to show. As reported by Mish Shedlock, unemployment is rising, while job openings have crashed. They are not quite in the recession territory, yet, but there’s a definite change towards that direction.

The economic surprise index of Bloomberg has fallen to levels last seen in mid-2019. The index measures the difference between forecasts and actualized economic data. Results below zero indicate that economic data is worse than expected. This is now occurring at a deepening pace.

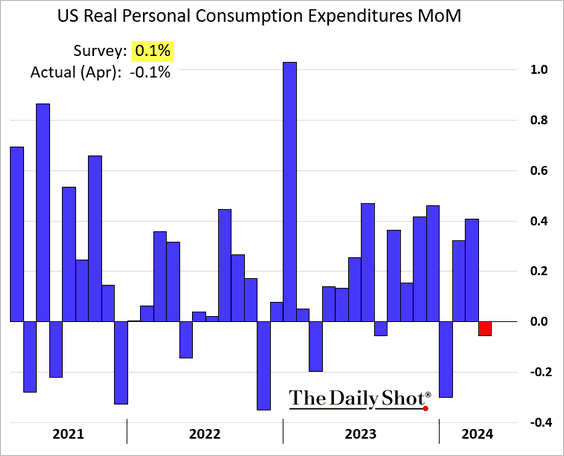

Moreover, consumer spending ebbed in April, which indicates that households are scraping the bottom of the barrel. We cannot draw such conclusions from just a one-month figure, but real income expectations have also fallen off the cliff. Also interest rates on credit card loans hitting new ATHs and credit card delinquencies reaching the highest level since Q4 2011, indicate that the U.S. consumer is reaching her limits to keep consuming at the current pace.

All the above adds to the argument I made a month ago that the U.S. has actually entered a recession already. This is not yet visible in the gross domestic product because of the gargantuan fiscal stimulus, but it will.

Credit markets in deep-sleep

The U.S. credit markets have been lulled into a state of deep-sleep. Stress of a looming recession is simply nowhere to be seen. Spreads of AA, BBB and CCC (and below) rated U.S. corporate debt continue to be tight as ever.1

They have naturally been pushed to this tightness by massive injections of liquidity (money supply), which I have been detailing for a year and a half. To note, liquidity injections are expected to turn into withdrawals by the month-end. Thus, I expect volatility to start increasing and market downdrafts to become more frequent and pervasive.

What worries me in the credit markets is that investors there seem waaay too complacent. Fall can bring nasty surprises to them in the form of retreating liquidity, recession and geopolitical tensions.

Conclusions

Like I’ve mentioned before, it has become more and more cumbersome to forecast the path of economies, not to say the world economy, because of the massive fiscal and monetary meddling of governments and central banks. If the Federal Reserve starts an aggressive rate cut cycle at the end of July, it might push the onset of an (GDP-measured) recession further. In am also rather confident that the Biden administration will keep fiscal stimulus running full-blast till the November elections, but in a consumer-driven economy it can only do so much. Most importantly, the U.S. economy has clearly started to weaken under the surface.

So, currently it looks that my call on the onset of a private sector recession a month ago was an accurate one. Credit recession continues in the U.S. and there starts to be definite signs that the consumer is about to break. Summer months should confirm the direction of travel, downwards, for the economy.

Disclaimer:

The information contained herein is current as at the date of this entry. The information presented here is considered reliable, but its accuracy is not guaranteed. Changes may occur in the circumstances after the date of this entry and the information contained in this post may not hold true in the future.

No information contained in this entry should be construed as investment advice. GnS Economics nor Tuomas Malinen cannot be held responsible for errors or omissions in the data presented. Readers should always consult their own personal financial or investment advisor before making any investment decision, and readers using this post do so solely at their own risk.

Readers must make an independent assessment of the risks involved and of the legal, tax, business, financial or other consequences of their actions. GnS Economics nor Tuomas Malinen cannot be held i) responsible for any decision taken, act or omission; or ii) liable for damages caused by such measures.

From the Fred database: The ICE BofA Option-Adjusted Spreads (OASs) are the calculated spreads between a computed OAS index of all bonds in a given rating category and a spot Treasury curve. An OAS index is constructed using each constituent bond's OAS, weighted by market capitalization.

Marc Faber or Jim Rogers pointed out that even though the money supply growth has been throttled by quantitative tightening, money is not tight as demonstrated by stock market performace and credit spreads. The "liquidity reservoir" you bring up--reverse repos or some similar phrase describing a phenomenon I haven't bothered to understand--is running dry, with rough riding ahead. Home building is slowing, which is another barometer of liquidity, with home builder stocks looking like they might have topped. It will be interesting to watch home builders when the Fed starts its long looked for rate cutting campaign to reelect Joe Biden. I think home builders and stock bulls may be disappointed. (I've a small short of home builders).